Learn the SECRETS of the Rich and Wealthy

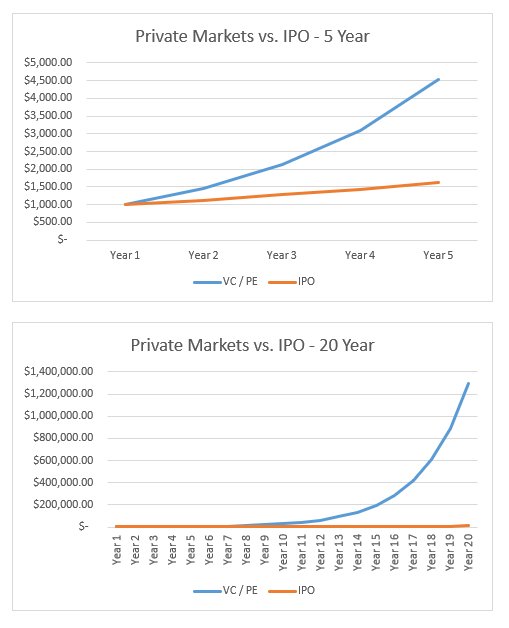

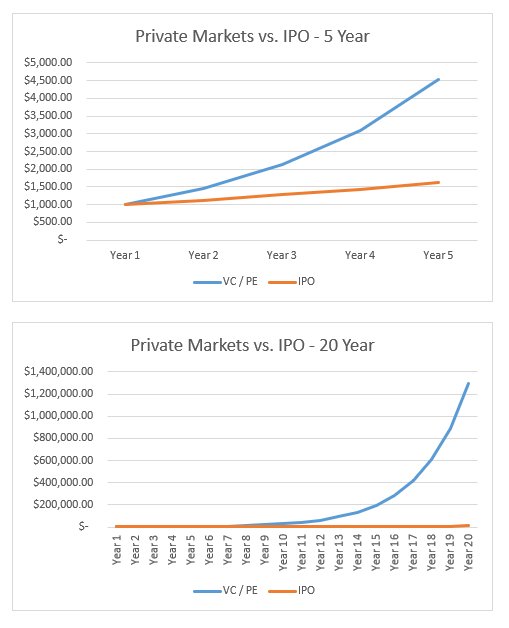

Are you interested to learn how many Billionaires became Billionaires? Or in other words, do you want to learn how to turn boat money into Yacht money? We have compiled a secret guide where this and more is laid out in plain English with steps anyone can follow. Take a look at these charts (below). Many people talk about hot IPOs but compare returns of the IPO average if you buy the day of the IPO and the Private Equity average.

Disclosure about the above charts: This is an average, private markets require a formula of investment which diversifies risk across multiple opportunities. Single investments may prove to result in a 100% loss of capital. But others may have 500% or even 2,500% returns, or somewhere in between. Overall, this requires diligent portfolio monitoring, risk assessment, due diligence, in other words - hard work. There isn't a strategy in the world where you can buy an ETF and press a button and become rich.

Generate real Generational Wealth

Ask yourself..

- Why are the average IPO returns 12.5% per year if you buy the day of the IPO, but the average Private Equity returns are upwards of 40% per year

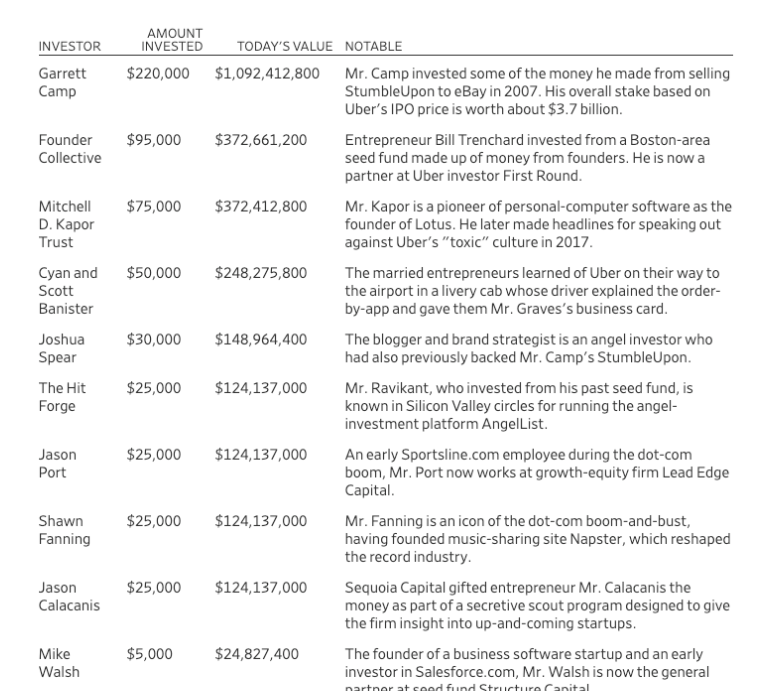

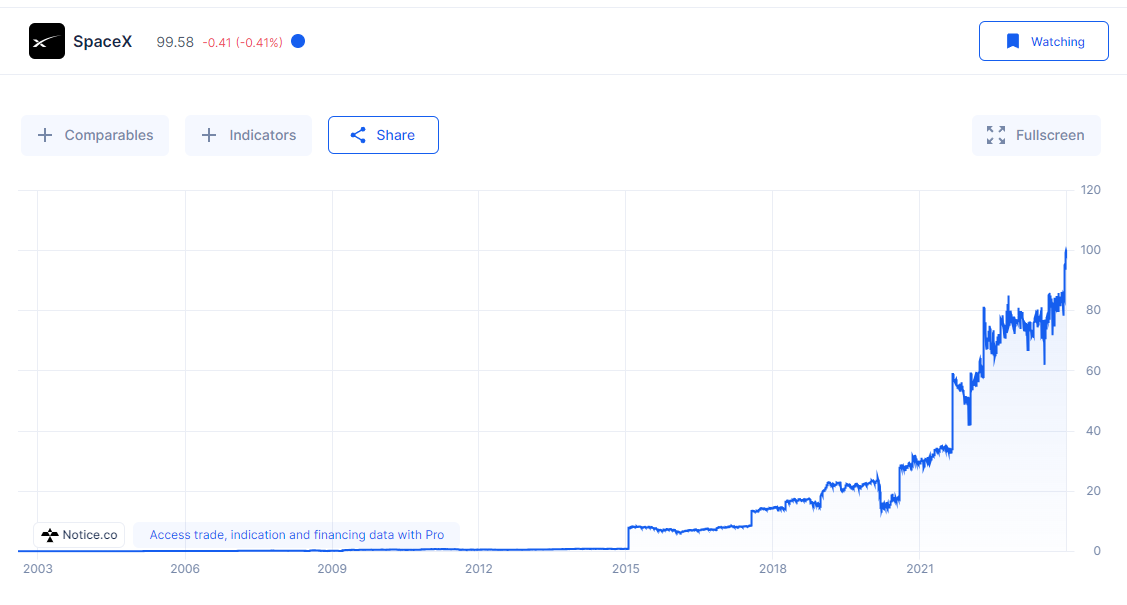

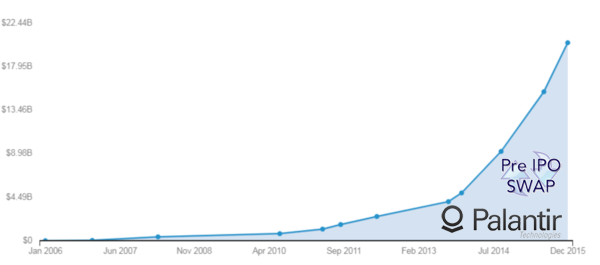

- How can you invest in companies like Uber, Palantir, Airbnb, Facebook, Microsoft, and others when the share price was less than $10/share and the company valuations were less than $1 Billion?

- Why is trading public markets so difficult, is anyone actually making money by trading?

Some examples of massive return on investment, over 1,000%

The Rich make their money in Private Equity - they invest in PE and sell in public markets. They sell stocks, mostly, they don't buy stocks. You're buying, they are selling, taking profits.

John Nichols PE Investor

What is Private Equity and Venture Capital

Learn from real insiders who know how these markets work, how to get involved in Private Equity and Venture Capital. What strategies did the Billionaires use to create Wealth, and how you can too.

It sounds too good to be true

There is a niche industry selling the same simple strategy to create Wealth, you can buy classes on Venture Capital, Trading, and other Strategies for thousands of dollars. It's not magic, it requires hard work and diligence, patience and talent. We can

Why are you giving this away for free?

The fact is this is not a competitive situation. Some early stage companies need $10,000,000 in financing, so there are plenty of opportunities to go around. The Billionaires have already made their money, they are looking for the best Golf Course in the world, not the next hot investment. There are plenty of opportunities for hungry investors that want to change their life. Having more smart people participate is beneficial for us, not competitive. There isn't a limited amount of profits to go around.

What's the catch?

- Wealth isn't created overnight, private investors have to be patient

- You need capital to start, if you don't have investment capital you need to first start saving

- Private markets investors have to be accredited

What's the upside?

- Accredited investor rules have loosened, and now include anyone with a financial license

- Many investors qualify with the $1m net worth (excluding your private residence)

- Only Reg D investments require Accreditation, as a non-accredited investor you can find many opportunities in Reg CF (Crowdfunding), Real Estate, and other strategies

What's the cost?

- The book Investors Guide to LEGAL Insider Trading is only $25 print and $10 kindle

- Our Udemy course costs only $50

Did you ever wonder...

- How wealth is created

- How people get Rich

- Is there a formula for success or they just get lucky

Risk Disclosure

Investing is risky you can lose all of your deposit and more. If you are considering making an investment please contact a registered financial advisor or other professional advisor. This website does not provide investment advice of any kind. Unreadpage.com is a website owned and operated by Macro Tech Titan Inc. a Delaware FinTech organization (“MTT”). By accessing this site and any pages therein, you agree to be bound by our Terms of Use and Privacy Policy. This page is intended only for accredited investors (for persons residing in the U.S.), and for persons residing abroad in jurisdictions where securities registration exemptions apply. This website is not a solicitation to sell securities and MTT does not engage in any solicitation of any kind. Information displayed on this blog is for information and educational purposes only. Investing is extremely risky and investors even if they are accredited should only invest funds they can afford to lose. By viewing this site we are making no claims or recommending any investments, nor suggesting any course of investment action.